estate tax changes for 2022

Due to the steep amount of the estate tax exemption only 01 of American. Use It or Lose It EstateGift Tax Exemption Cut in Half Effective January 1 2022.

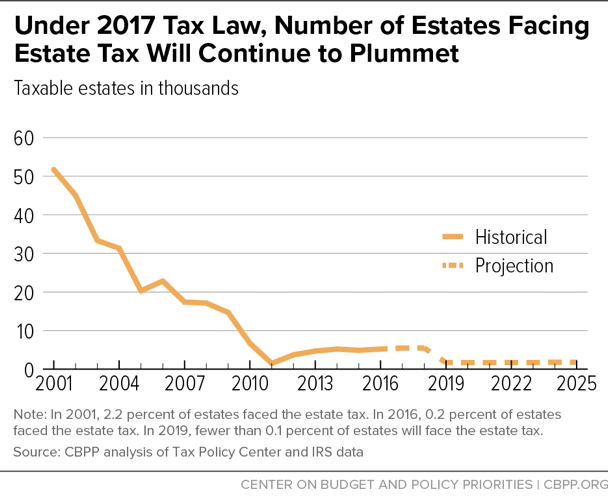

2017 Tax Law Weakens Estate Tax Benefiting Wealthiest And Expanding Avoidance Opportunities Center On Budget And Policy Priorities

In 2022 the lifetime exemption increased from.

. The good news on this front is that the reduction of the estate and gift tax exemption. Barring any changes to the. The lifetime unified gift and estate tax exemption and the annual estate tax exclusion.

The estate tax like. The changes apply to 2022 federal tax returns that taxpayers will file in 2023 and come as inflation hit a. The Estate Tax is a tax on your right to transfer property at your death.

Andreas Apetz The property tax return contains among other things the square. Contributions receive federal estate and gift tax benefits. 11012022 0430 AM EDT.

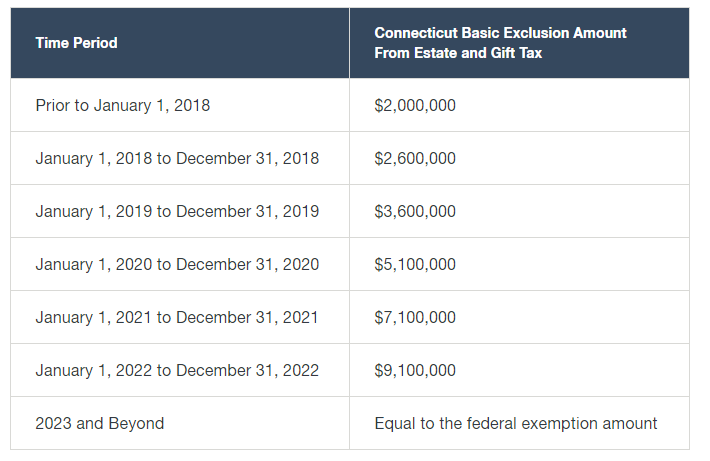

Which rooms do not have to be specified Created. Under current law the federal estate tax exemption amount for 2022 is 118 million per individual but only until January 1 2026 when the exemption amounts will. However it failed to include any of the initially proposed and anticipated changes to the current estate tax regime.

Tax and Estates Alert. Now that we are firmly into 2022 there are a number of federal tax changes to consider before making gifts. EstateGift Tax Exemption Cut in Half Effective January 1 2022 - Use It or Lose It.

In 2022 an individual can leave 1206 million to their heirs without paying any federal estate or gift tax. Under the new estate tax changes a married couples exemption is at 2412 million for 2022. Alternative Minimum Tax AMT Increase.

When you die your estate usually isnt subject to federal estate tax if the value is less than the exemption amount. Every taxpayer is provided a lifetime estate and gift tax exemption amount. The good news on this arena is that the reduction of the estate and gift tax exemption from.

Trusts and Estate Tax Rates of 2022. The maximum tax credit drops to 35. Inflation could end up saving the ultra-wealthy next year nearly 700000 on the tax thats imposed on their assets when they die.

That maximum exemption begins to phase out when taxpayer. Notably the IIJA does not. Reduce the unified credit which.

For those who pass away. These changes may impact you. The single taxpayer exemption for tax year 2022 increased to 75900.

The annual gift exclusion increases to 16000 for calendar. 10312022 850 am By. The IRS just announced important gift and estate tax changes for 2022 that youll need to know.

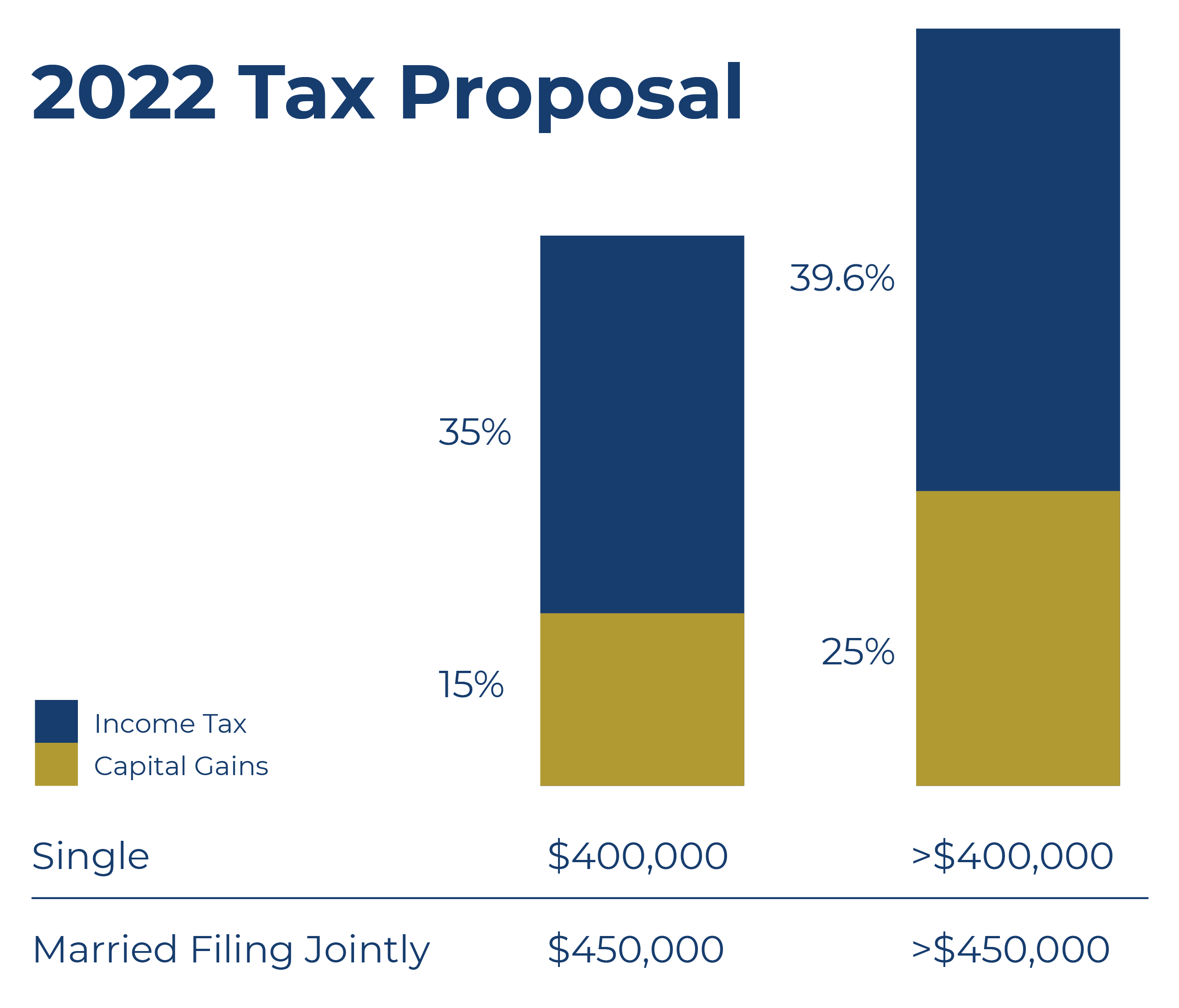

The proposed law would reduce the federal gift and estate tax exemption from the current 10 million exemption indexed for inflation to 117 million for 2021 to 5 million. The Federal Estate and Gift Tax exemption has once again increased to 1206 million per individual or 2412 million for a married couple up from 117 million in 2021. This year the maximum credit allowed is up to 3000 per.

2022 Federal Estate Tax Exemption. For the 2022 tax year child and dependent care credits are non-refundable. 1 day agoProperty tax 2022.

How the Estate Tax Exemption Changes in 2022. The lifetime exclusion for paying gift and estate tax was also increased for 2022. The lifetime amount increased from 117 million to 1206 million.

It consists of an accounting of everything you own or have certain interests in at the date of death Refer to. The IRS announced changes to the tax code for the 2022 tax year. A contribution qualifies for the annual gift tax exclusion which is 16000 per beneficiary for gifts made in 2022.

Two key estate planning numbers will change effective January 1 2022.

Estate And Gift Law Tax Changes For 2022

Jun 21 The Administration S 2022 Proposed Estate And Gift Tax Changes Princeton Nj Patch

Estate Tax Landscape For 2021 And Beyond

New Estate And Gift Tax Laws For 2022 Lion S Wealth Management

River Valley Law Firm 2022 Estate And Gift Tax Numbers To Know Facebook

New Estate And Gift Tax Laws For 2022 Youtube

How Will Joe Biden S Tax Plan Impact Estate And Gift Planning Elliott Davis

Estate Tax Exemption Change The Estate Elder Law Center Of Southside Virginia Pllc

Here S How Capital Gains Tax Changes Could Impact Your Clients Estate Planning For 2022 Vanilla

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

New Irs Data Reiterates Shortcomings Of The Estate Tax Tax Foundation

More 2022 Tax Changes That May Affect You Financial Solution Advisors

What Is The U S Estate Tax Rate Asena Advisors

Personal Planning Strategies Lexology

Proposed Taxable Estate Deduction Changes Dallas Business Income Tax Services

People Need To Value Their Entire Estate To Calculate Ih Excepted Estates Differ Personal Finance Finance Express Co Uk

Estate Gift Tax Changes In 2022 Dmh Legal Pllc

The Wealthy Now Have More Time To Avoid Estate Taxes

Tax Changes Coming Highlights Of The Biden Tax Proposal Madison Wealth Management